Introduction :

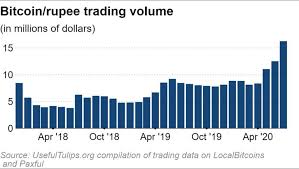

In the past few days, the Indian Government has proposed a ban on the use of private currencies and has introduced a bill for the same in the ongoing Budget Session. The bill has been introduced in the Parliament to pave way for a national, centralized cryptocurrency in the Indian Subcontinent.

The circulation of private cryptocurrencies has been a contentious issue for the governments and to support the needs of several industries and international-based groups, the authorities have tried to come up with bills to support the digital influx of currency

The issue with Digital Currency :

The circulation of cryptocurrency often poses a threat to both the cyber-infrastructure as well as the financial markets of a nation. Most people who have tried to invest in cryptos found themselves on the wrong side of a hacker, a theft, or a scam. By using this form, there’s always a high chance that one might end up losing everything that you put in due to a valuation crash, driving away many advisors.

Most big box retail stores don’t want to accept cryptocurrency because of the volatility as well as the high price they need to pay to accept it. To counter this, cryptocurrency credit cards are being used.

Furthermore, many of the most popular cryptocurrencies aren’t scalable—either in transaction time, value, or the amount of power needed to process them. Bitcoin already has a lot of difficulties when it comes to the amount of time and computing power needed to provide proof-of-work for a transaction. The more transactions happen, the worse the problem gets and eventually will collapse.

It has been estimated that the ban on private cryptocurrency will lead to a humungous loss of Rs 90,00 crore for around 7 million entities.

Strategy to move ahead :

Instead of a blanket ban on the use of cryptocurrency, the following steps can be taken to create a flourishing ecosystem for both the private and the central cryptocurrency :

- Creating location-specific policies: Cryptocurrencies are here to stay. Regulators need to benchmark policies against those in geographies such as Singapore, Switzerland, and the US and work with bodies like the G-20 to address common concerns around money laundering, taxation, and potential criminal usage. Corporations and crypto firms with Indian stakeholders should have a say in the policy and regulatory development process.

- Introducing Sandboxes: Nodal agencies such as Startup India can work with accelerators as well as corporations that are already heavily active in this space. Also, the banks and payment giants can get involved, attract entrepreneurs from India and the world to come in, and address use cases that solve real problems.

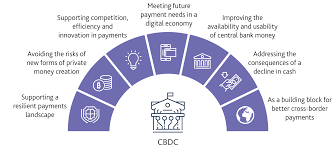

- Setting up of Central Bank Digital Currencies (CBDCs): Multiple governments across the world are investing in developing Central Bank Digital Currencies (CBDCs), which are digital versions of national currencies. China’s digital yuan project is being rolled out across the country and over platforms such as Alibaba and WeChat. Iran and Russia, among others, have been working on CBDCs to attempt to upgrade their bank systems where access to the SWIFT network is paramount. The International Monetary fund (IMF) has acknowledged the potential for CBDCs to address key problems with cross-border remittance, currency substitution, and transparent public book-keeping. Closer to home, Pakistan’s Securities and Exchange Commission recently published a draft regulation on its stand.

It is clear that although cryptocurrencies are complex to regulate, they hold vast potential to enhance the digital economy, especially in a fast-growing digital age.

Sources :

Live mint.com

Times of India

BloombergQuint

The Hindu

Leave a comment